Following the introduction of the Mortgage Market Review (MMR) some lenders have introduced new age restrictions for their mortgage lending. If you are looking for a mortgage for over 60s or a mortgage for over 50s then you will probably find out that your choices are more limited than compared to a couple of years ago. MMR was not introduced to inhibit affordable lending, but it was designed to stop excessive lending to people at significant risk of not being able to meet their future payment needs, especially when interest rates rise.

However some lenders, fearful of the new regulation have introduced age limits, often 65 as a cap for when they wish their mortgages to be paid off. Some lenders are fearful that borrowers cannot provide their pension income or that if with a joint mortgage one partner receives a larger pension than the other, should they separate or die, their surviving partner would not be able to afford the mortgage alone. In reality both issues can be overcome. For example, all couples of any age are at risk of separation or even sadly death. Future pension calculations may be complicated or even hold a degree of uncertainty if retirement is decades away, but a pragmatic approach should be able to overcome both of these issues.

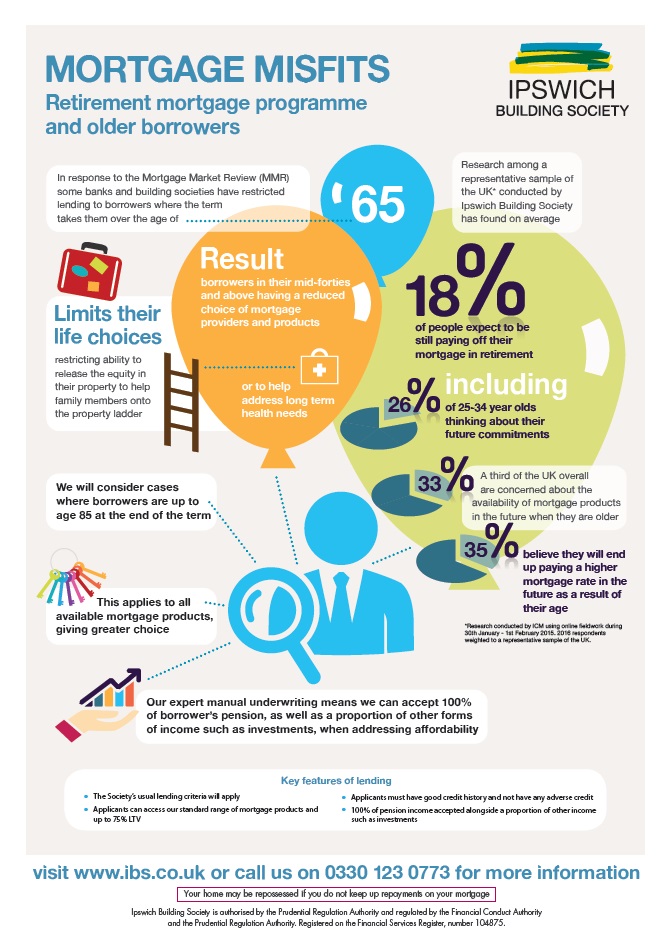

In fact there are some lenders such as Ipswich Building Society who use manual underwriting to assess all their mortgage applications. This means they will happily review mortgages for pensioners and use human beings, not machines to make their lending decisions.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP WITH YOUR MORTGAGE REPAYMENTS

Ipswich Building Society specializes in mortgages for older people, the retired, approaching retirement and those in their 50s, 60s and above.