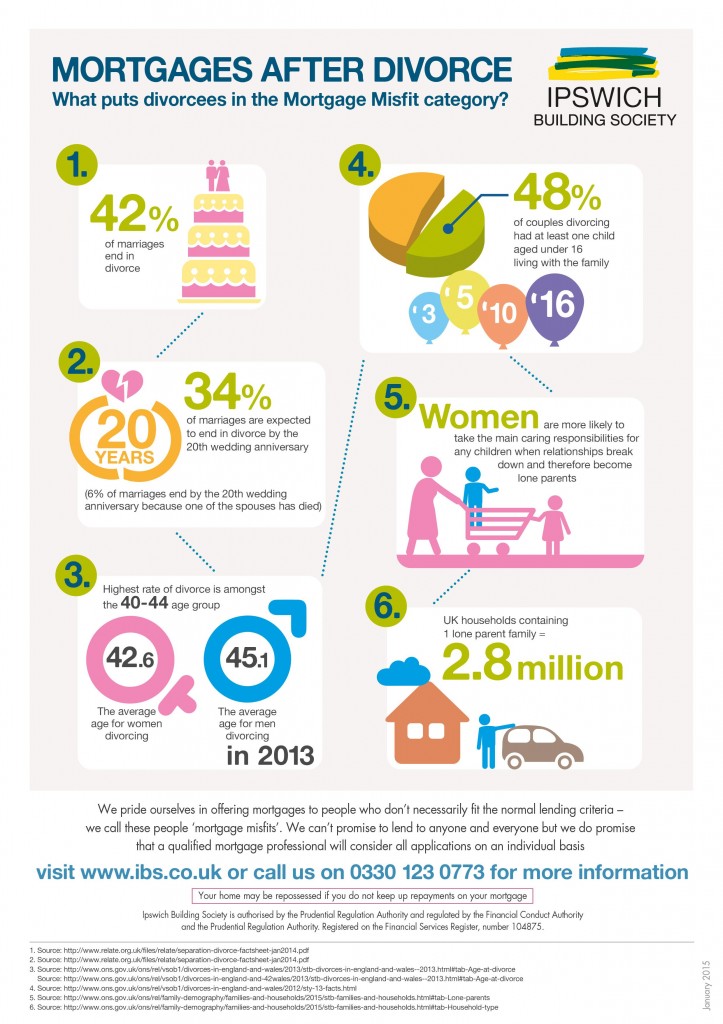

Divorce enquiries typically surge on the first working Monday in January, a day now known as ‘Divorce Day’. It’s no secret 42% of all marriages end in divorce, and the festive season can feel like a bridge too far for some relationships. So, when the resolutions have been made and January bills are stacking up, what are the practicalities of getting a mortgage after divorce?

In the wake of the 2014 Mortgage Market Review lenders are applying stricter affordability calculations, assessing applicant’s incomes and outgoings to judge affordability not only now but also for future rate rises. This has resulted in many divorcees finding themselves inadvertently part of a group termed ‘mortgage misfits’ – those finding it hard to obtain a mortgage.

Obviously one of the main impacts of affordability post-divorce is a reduced household income, but also due to the way mortgage lenders assess child maintenance payments – many lenders fail to consider this in their affordability calculations. It seems a little at odds when you consider 48% of couples divorcing had at least one child aged under 16 living with the family.

You may also benefit from finding a lender who uses manual underwriting rather than computer based assessments. They will be able to look at your individual situation rather than a one size fits all, or computer says no, model.

There are a few mortgage lenders out there who will accept 100% of child maintenance payments in addition to employment income when calculating affordability. One of these is Ipswich Building Society, who pledge to use a common sense approach to mortgage applicants and accepts 100% of child maintenance, where supported by a CSA or Court Order with 5 years left to run.