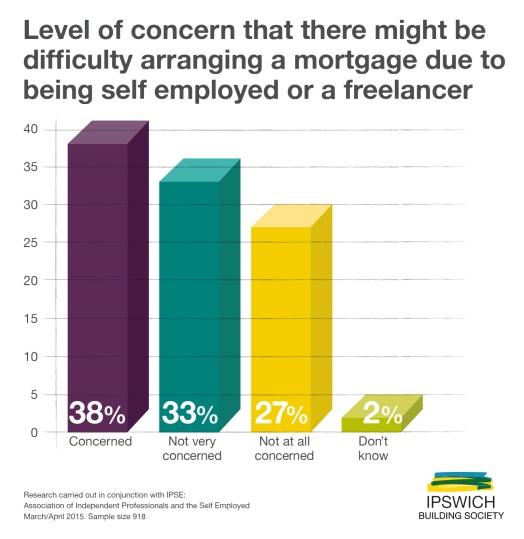

Recent research into self employed mortgages has identified that 2 in 5 of self employed people are concerned that their employment status will impact their chance of getting a mortgage.

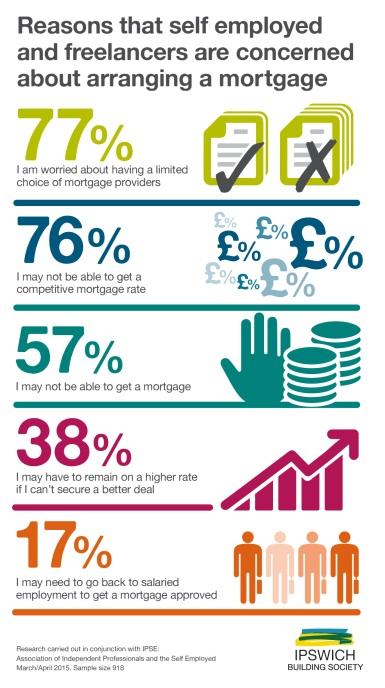

Following changes to the mortgage market, mortgage lenders must now under regulation ensure all borrowers of any salary or income type can afford their mortgage. This requires all mortgage applicants including those looking for a self employed mortgage to provide more robust evidence of income and expenditure than before. However whilst the process to get a self employed mortgage may require some additional pieces of evidence compared to those in salaried occupations, not all is lost. In the same survey 77% of respondents were concerned about lack of choice of suppliers for self employed mortgages.

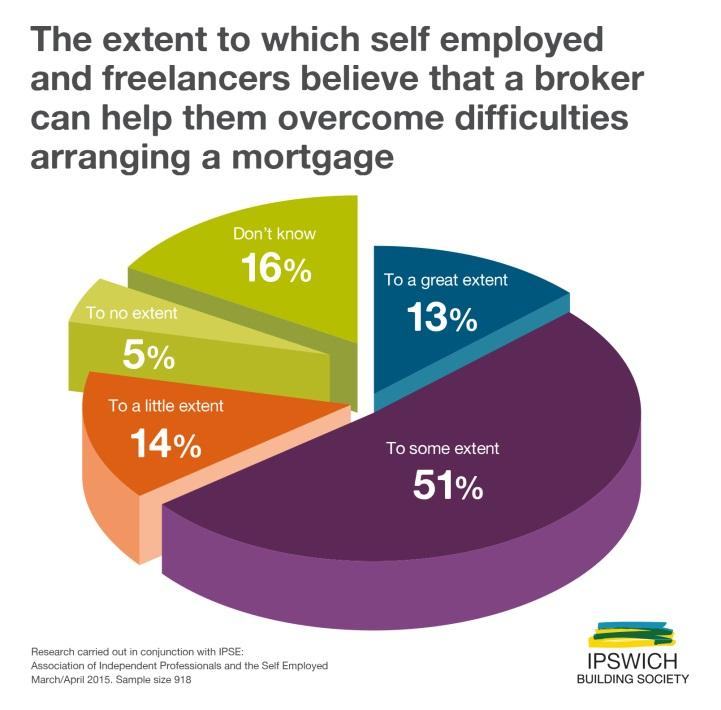

However, 78% of respondents also stated that they believed using a mortgage broker would help them to overcome the difficulties they faced to get a self employed mortgage.

Whilst some mortgage lenders find it harder to offer self employed mortgages, there are lenders often smaller banks and regional building societies that specialise in providing mortgages for self employed. Larger lenders often use automated processes and computers to make their lending decisions. Whilst this is efficient it can be difficult to assess more complex cases such as self employed mortgages using automated processes. Lenders who specialise in mortgages for self employed often use manual underwriting; this means that human beings make their lending decisions. This approach enables these mortgage lenders to assess every case individually and to take the time and attention to understand the needs of the individual and the self employed business in relation to the self employed mortgage. Ipswich Building Society has produced a useful video to explain more about self employed mortgages.

Find our more about Self Employed Mortgages – Product Information.